Mercedes-Benz EQA Price in Chennai

The ex-showroom price of the Mercedes-Benz EQA in Chennai starts at Rs. 66.00 lakh for the 250 Plus base model. The top model of the Mercedes-Benz EQA is 250 Plus, which costs Rs. 66.00 lakh (ex-showroom). Check the April 2025 offers/deals on Mercedes-Benz EQA in Chennai and book a test drive now.

The main competitors of the EQA are Volvo XC40 Recharge and Volvo XC40 Recharge. The Volvo XC40 Recharge is the most affordable rival of the EQA and its prices start at Rs. 56.90 lakh (ex-showroom). The Volvo XC40 Recharge is the most expensive competitor of the Mercedes-Benz EQA with an ex-showroom price of Rs. 56.90 lakh.

Mercedes-Benz EQA On-Road Price in Chennai, Tamil Nadu

Get on-road car price of the Mercedes-Benz EQA in Chennai. On-road price of a car includes the ex-showroom price in the city, road tax, insurance & handling charges, Fastag cost, etc.

| Ex-Showroom Price | ₹66,00,000 |

| TCS | ₹66,000 |

| Registration Charges | ₹600 |

| FASTag | ₹600 |

| Hypothecation Endorsement | ₹1,500 |

| Road Safety Cess | ₹11,880 |

| Other Charges | ₹400 |

| Insurance | ₹3,30,000 |

| On-Road Price in Chennai: | ₹70,10,980 |

Sell used car from the comfort of your home. Get free car assessment, quick payment disbursal and free RC transfer. Book car inspection right now to find out how much payment you can get for selling it today.

Compare Prices of EQA Rivals

FAQs

Certainly! To calculate the on-road price with only the main charges, focus on the following components:

Ex-Showroom Price

Road Tax/Registration Charges

Insurance

Calculation Example:

Let's take a car with an ex-showroom price of ₹10,00,000.

Ex-Showroom Price: ₹10,00,000

Road Tax/Registration Charges (Assuming 10%): ₹10,00,000 x 10% = ₹1,00,000

Insurance (Assuming 5% of ex-showroom price): ₹10,00,000 x 5% = ₹50,000

Total On-Road Price = Ex-Showroom Price + Road Tax + Insurance

Total On-Road Price = 10,00,000 + 1,00,000 + 50,000 = ₹11,50,000

So, the on-road price of the car, considering only the main charges, would be ₹11,50,000.

Note:

The percentages for road tax and insurance can vary by state and specific car model.

Always check the exact percentages and costs with your car dealer or relevant authorities.

The ex-showroom price and the on-road price are two different cost components involved in purchasing a car. Here’s a detailed breakdown of the differences:

Ex-Showroom Price:

Definition: The ex-showroom price is the price of the car as sold by the manufacturer to the dealer, plus the dealer's margin. It includes the Goods and Services Tax (GST) but excludes other on-road costs such as insurance, registration, and additional charges.

Components Included:

Base price of the car

Dealer’s margin

Goods and Services Tax (GST) and any applicable cess

Exclusions:

Road tax/registration charges

Insurance

Handling charges

Any additional charges like accessories or extended warranty

On-Road Price:

Definition: The on-road price is the final price a buyer pays to drive the car out of the dealership. It includes the ex-showroom price plus all additional costs required to make the car road-legal and operational.

Components Included:

Ex-showroom price

Road tax/registration charges (varies by state)

Insurance (third-party and/or comprehensive)

Handling charges

Optional accessories

Extended warranty (optional)

Other miscellaneous charges (e.g., fast tag, number plates)

Key Differences:

Scope:

Ex-Showroom Price: Limited to the car’s base cost, dealer margin, and GST.

On-Road Price: Comprehensive, including all costs required to legally drive the car on the road.

Cost:

Ex-Showroom Price: Lower, as it doesn’t include additional taxes, insurance, or fees.

On-Road Price: Higher, as it encompasses all necessary expenses beyond the ex-showroom price.

Purpose:

Ex-Showroom Price: Used as a reference for the base cost of the car, often used in advertisements.

On-Road Price: Represents the total cost of ownership at the point of purchase, reflecting the actual amount a buyer needs to pay.

Example Calculation:

For a car with an ex-showroom price of ₹10,00,000:

Ex-Showroom Price: ₹10,00,000

On-Road Price Calculation:

Ex-Showroom Price: ₹10,00,000

Road Tax (Assuming 10%): ₹1,00,000

Insurance (Assuming 5%): ₹50,000

Total On-Road Price: ₹10,00,000 + ₹1,00,000 + ₹50,000 = ₹11,50,000

In this example, the ex-showroom price is ₹10,00,000, while the on-road price is ₹11,50,000, demonstrating how additional mandatory costs are included in the on-road price.

70.5kWh

Battery190PS/385Nm

Performance560km

RangeElectric

Fuel TypeSUV

Body Type5 Seater

Seat CapacityMercedes-Benz EQA On-Road Prices In Top Cities

- Check EQA On-Road Price In Delhi

- Check EQA On-Road Price In Gurgaon

- Check EQA On-Road Price In Noida

- Check EQA On-Road Price In Mumbai

- Check EQA On-Road Price In Bangalore

- Check EQA On-Road Price In Hyderabad

- Check EQA On-Road Price In Lucknow

- Check EQA On-Road Price In Pune

- Check EQA On-Road Price In Ahmedabad

- Check EQA On-Road Price In Chennai

- Check EQA On-Road Price In Rajkot

- Check EQA On-Road Price In Nashik

- Check EQA On-Road Price In Nagpur

- Check EQA On-Road Price In Kolhapur

- Check EQA On-Road Price In Kanpur

- Check EQA On-Road Price In Faridabad

- Check EQA On-Road Price In Bhopal

- Check EQA On-Road Price In Surat

- Check EQA On-Road Price In Udaipur

- Check EQA On-Road Price In Varanasi

- Check EQA On-Road Price In Patna

Mercedes-Benz EQA Related Videos

Mercedes-Benz EQA Related News

2025 Mercedes-Benz CLA Debuts – EV Boasts 792km Range, Hybrid Promises Diesel-Like Efficiency

Mercedes-Benz have unveiled the 2025 CLA, their all-new entry-level luxury sedan. The new...

Mercedes-Benz Confirm Lineup For 2025 Bharat Mobility Global Expo

Mercedes-Benz India have confirmed their lineup for the upcoming Bharat Mobility Global...

Mercedes-Benz Set To Hike Car Prices On 1 January, 2025 (Press Release)

Mercedes-Benz India have announced a price increase of up to 3% across its entire model...

Mercedes-Benz Open Bookings For EQG Electric SUV Ahead Of Launch

At the launch of the new EQA and EQB electric SUVs, Mercedes-Benz India announced they...

Upcoming Cars In July 2024 - Nissan X-Trail, Mini Cooper, BMW 5 Series LWB

Here’s a list of all upcoming cars in July 2024. Our list includes the likes of the...

Mercedes-Benz India Post Best-Ever Sales Figures In 2023-24

Mercedes-Benz India are riding a wave of success currently after posting their best-ever...

Mercedes-Benz To Launch 3 New EVs In H2 2024

Mercedes-Benz India held their latest quarterly sales announcement meeting recently where...

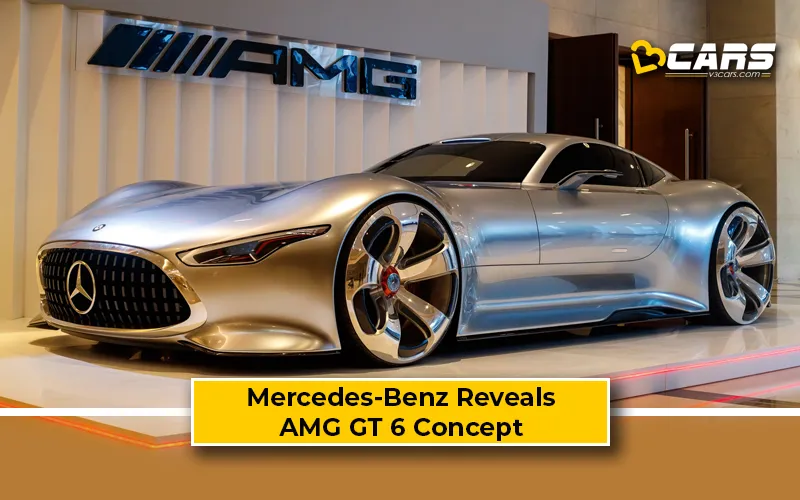

Mercedes-Benz Reveals AMG GT 6 Concept in Mumbai (Press Release)

Mercedes-Benz unveiled the AMG Vision Gran Turismo, a visionary super sports concept car...

Mercedes-Benz India To Showcase Iconic Luxury SUVs and Concept EQG at Bharat Mobility Show 2024 (Press Release)

Mercedes-Benz India will showcase a range of concept and production SUVs from February 1st...

Mercedes-Benz Set To Hike Car Prices On 1 January, 2024 (Press Release)

Mercedes-Benz India have announced a price increase of up to 2% on select models owing to...

New Mercedes-Benz CLE To Replace C- And E-Class Coupe Unveiled

Mercedes-Benz have unveiled the new CLE Coupe for global markets. The Mercedes CLE Coupe...

Mercedes-Benz India Reveal Waiting Period For 2023 Models

At the launch of the Mercedes-AMG GT 63 S E Performance, the German carmaker revealed the...

All Mercedes-Benz Cars To Get A Price Hike Soon

Mercedes-Benz India have announced a price hike for their entire range of cars sold in the...

Mercedes-Benz India Strengthen Presence In Tamil Nadu With A New Dealership

Mercedes-India recently inaugurated a new dealership in Coimbatore, Tamil Nadu to...

Mercedes Inaugurates India’s First Integrated AMG Performance Centre In Ahmedabad

Mercedes Benz have inaugurated India’s first integrated AMG Performance Centre in...

Popular Models

FAQs

Certainly! To calculate the on-road price with only the main charges, focus on the following components:

Ex-Showroom Price

Road Tax/Registration Charges

Insurance

Calculation Example:

Let's take a car with an ex-showroom price of ₹10,00,000.

Ex-Showroom Price: ₹10,00,000

Road Tax/Registration Charges (Assuming 10%): ₹10,00,000 x 10% = ₹1,00,000

Insurance (Assuming 5% of ex-showroom price): ₹10,00,000 x 5% = ₹50,000

Total On-Road Price = Ex-Showroom Price + Road Tax + Insurance

Total On-Road Price = 10,00,000 + 1,00,000 + 50,000 = ₹11,50,000

So, the on-road price of the car, considering only the main charges, would be ₹11,50,000.

Note:

The percentages for road tax and insurance can vary by state and specific car model.

Always check the exact percentages and costs with your car dealer or relevant authorities.

The ex-showroom price and the on-road price are two different cost components involved in purchasing a car. Here’s a detailed breakdown of the differences:

Ex-Showroom Price:

Definition: The ex-showroom price is the price of the car as sold by the manufacturer to the dealer, plus the dealer's margin. It includes the Goods and Services Tax (GST) but excludes other on-road costs such as insurance, registration, and additional charges.

Components Included:

Base price of the car

Dealer’s margin

Goods and Services Tax (GST) and any applicable cess

Exclusions:

Road tax/registration charges

Insurance

Handling charges

Any additional charges like accessories or extended warranty

On-Road Price:

Definition: The on-road price is the final price a buyer pays to drive the car out of the dealership. It includes the ex-showroom price plus all additional costs required to make the car road-legal and operational.

Components Included:

Ex-showroom price

Road tax/registration charges (varies by state)

Insurance (third-party and/or comprehensive)

Handling charges

Optional accessories

Extended warranty (optional)

Other miscellaneous charges (e.g., fast tag, number plates)

Key Differences:

Scope:

Ex-Showroom Price: Limited to the car’s base cost, dealer margin, and GST.

On-Road Price: Comprehensive, including all costs required to legally drive the car on the road.

Cost:

Ex-Showroom Price: Lower, as it doesn’t include additional taxes, insurance, or fees.

On-Road Price: Higher, as it encompasses all necessary expenses beyond the ex-showroom price.

Purpose:

Ex-Showroom Price: Used as a reference for the base cost of the car, often used in advertisements.

On-Road Price: Represents the total cost of ownership at the point of purchase, reflecting the actual amount a buyer needs to pay.

Example Calculation:

For a car with an ex-showroom price of ₹10,00,000:

Ex-Showroom Price: ₹10,00,000

On-Road Price Calculation:

Ex-Showroom Price: ₹10,00,000

Road Tax (Assuming 10%): ₹1,00,000

Insurance (Assuming 5%): ₹50,000

Total On-Road Price: ₹10,00,000 + ₹1,00,000 + ₹50,000 = ₹11,50,000

In this example, the ex-showroom price is ₹10,00,000, while the on-road price is ₹11,50,000, demonstrating how additional mandatory costs are included in the on-road price.