What Is BH Series Number Plate, Eligibility, Registration, Pros & Cons?

One of the recent changes in the vehicle registration rulebook has been the introduction of the BH series number plate. Introduced in August 2021, the BH registration series aims to benefit those who have transferable jobs or change their state of residence frequently. It aims to solve the problem of re-registering the vehicle every time someone moves to another state within India. If you have some queries regarding the BH registration series or are keen to know more then this article is for you.

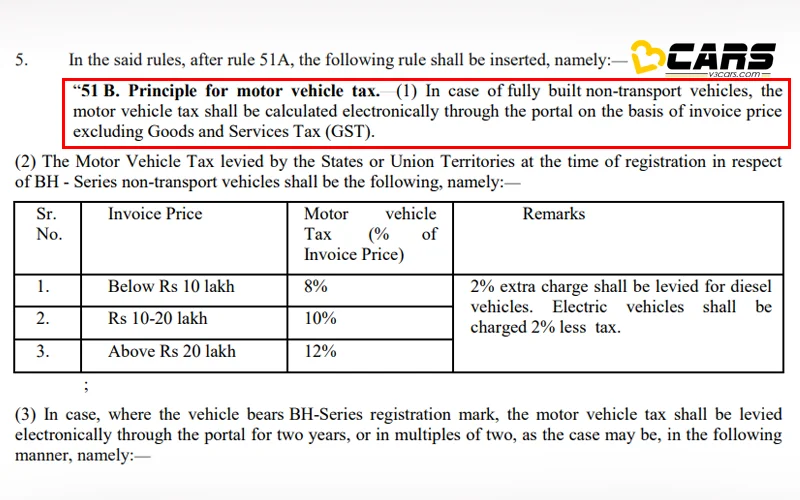

Update (Aug 28, 2024): Thanks to Mr. Manish Gupta for bringing a piece of potentially incorrect info in this article to our attention. Kindly refer to the “Tax Structure” heading in this article. Mr. Gupta purchased a vehicle and was charged for BH registration based on the invoice price including GST. Meanwhile, we had mentioned about the BH registration on invoice price tax excluding GST. After thoroughly searching the web for government notifications regarding any amendments to the Motor Vehicle Act pertaining to the BH registration, we could only find a document. Click Here.

This notification from Ministry of Road, Transport and Highways (MoRTH), dated August 26, 2021, says:

In case of fully built non-transport vehicles, the motor vehicle tax shall be calculated electronically through the portal on the basis of invoice price excluding Goods and Services Tax (GST).

Generally, registration is charged per the ex-showroom price regardless of the invoice price. Although, in some cases, it sounds possible that some states may charge registration fees as per the invoice price. In this case, you can get a lower cost in registration tax if you bought the car at a discount (invoice price < ex-showroom price) from the dealer.

However, it’s more than rare to find a situation where the government are charging registration tax based on the invoice price excluding the GST. That would drastically bring down the taxable amount, and thus, government’s revenue. For now, we’re holding the information as is in this article. We’ll have to further look into this and try to find clarification from legal experts, who are better at understanding the complex language of the government containing technical jargons, which sometimes contradict themselves.

What Is BH Series Number Plate?

Unlike regular number plates, the BH series number plates are valid throughout the country. So, even if you change the state of residence, after a year or 4 years of purchasing a vehicle, you won't need to re-register it in the new state. This is how a BH vehicle registration plate looks.

Note: Check your Car EMI with our - Car EMI Calculator

The central government introduced the BH series number plate to dismiss this complex process in September 2021. People with a transferable job can register their new car with this number plate series and easily travel across the country. Unlike regular number plates, the BH series number plates are valid throughout the country.

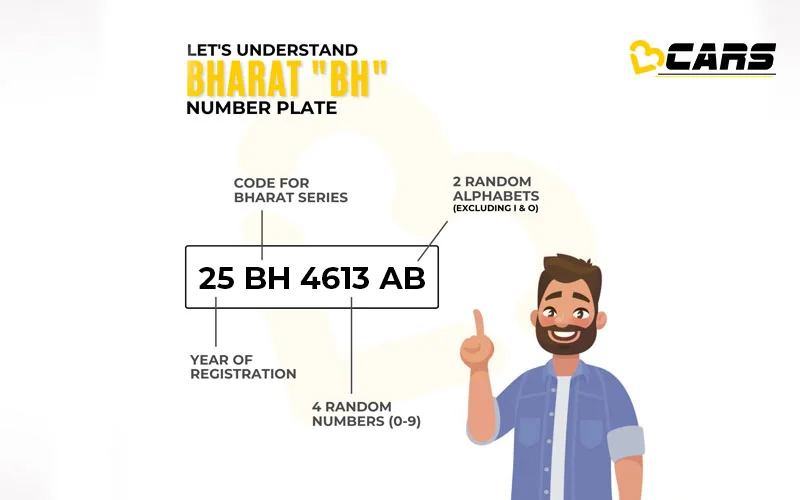

BH Series Number Plate – Decoding

Here, the first 2 numbers signify the year of registration, 2025 in this case, followed by BH, which stands for Bharat. Then there are 4 random, computer-generated numbers followed by 2 random alphabets excluding ‘I’ and ‘O’.

The usual registration plates have a sequence that starts with the two-letter code of the state, followed by the area's RTO code, two randomly assigned letters, and four randomly assigned numbers. This is how a regular vehicle registration plate looks:

MH 01 AA 1111

On the other hand, a BH series number plate looks like this:

25 BH 1111 AA

Here, the first 2 numbers signify the year of registration, 2025 in this case, followed by BH, which stands for Bharat. Then there are 4 random, computer-generated numbers followed by 2 random alphabets excluding ‘I’ and ‘O’.

Also Read: How to Apply for a High Security Number Plate Online?

BH Series Number Plate – Eligibility

As mentioned, the BH series number plate is for people with transferrable jobs.

The following people are eligible to get a BH series number plate:

- Central and state government employees

- Employees of PSUs such as BHEL, ONGC, BSNL, etc.

- Defence personnel

- Employees of a company having offices in at least 4 states/UTs

Also Read: State Code by Regional Transport Office (RTO) of India

How To Get a BH Series Number Plate?

It is a relatively simple process. One needs to submit the office ID card copy (applicable for government employees) or working certificate in Form 60 (for private employees) to the dealership. Then the dealer will apply for the BH registration which will take a few days to get allotted.

Note: Currently, the BH series number plate is only available for new, privately owned, non-transport vehicles.

BH Series Number Plate – Tax Structure

When you get a new car registered with the regular number plate, you have to pay road tax for 15 years at once during the purchase. Additionally, the tax value varies depending on various aspects of the car, such as the length of the car, engine capacity, etc.

If you get your car registered with the BH series number plate, you will only have to pay road tax for the 2 years after the purchase. After that, you will have to pay road tax every 2 years. You can pay this road tax via the official e-vahan website.

Additionally, the road tax for a BH series-registered vehicle is calculated on the invoice value of the car excluding GST rather than on the ex-showroom price. This means that if you get a good discount on a car, the tax will be calculated on the discounted price of the car, saving you some money there as well. Here is the tax structure for a car registered with the BH series number plate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The tax structure given above is for a petrol car. Electric vehicles will get a 2% waiver whereas diesel cars will be charged 2% extra. The tax calculated on the given basis will be for 15 years, which you will have to pay every 2 years for 14 years, followed by annual tax submission.

Note: Check your car’s fuel cost with Fuel Cost Calculator India

BH Series Number Plate – Pros

Here are the benefits of the BH series number plate:

- Hassle-free ownership across the country

- Low upfront cost

- Lower road tax

BH Series Number Plate – Cons

Here are the shortcomings of the BH series number plate:

- Not available for old or commercial vehicles

- Submitting road tax periodically could be time-consuming

- Cannot get a number of one’s choice as it is computer-generated

BH Series Number Plate – Should You Get One?

If you are eligible to get one and have a transferable job, we suggest going for the BH series number plate for the advantages easily outweigh its shortcomings.

BH Series Number Plate – What Will Change For 2025?

For 2025, the BH series number plate’s initials will be changed from ‘22’, '23', and ‘24’ to ‘25’. The number plates for the next year may also be a different set of computer-generated numbers, leaving the ones that have been exhausted in the past. A similar case is also likely to apply to the 2 random numbers at the end of the number plate that currently do not include ‘I” and ‘O’.

In March 2025, the Ministry of Road Transport and Highways (MoRTH) proposed easing the BH number plate application process by amending Rule 48 of the Motor Vehicles Act 1988, and also allowed existing vehicles to convert to the BH series.

Note: List of Upcoming Cars in India

Actual User Situation: I want to buy a used 2022 Tata Tiago (iCNG XZ Plus) with a BH number, registered in Pune RTO, Maharashtra, and transfer ownership to Nashik RTO, Maharashtra. I've received conflicting information from RTO agents about the transfer process and eligibility for a BH series number.

Could you clarify how to transfer the BH series to a state series number? It doesn't seem to be available on the Parivaahan portal. Am I eligible for a BH series number if I work in a company with offices in 4+ states? What documents are needed from my employer to submit to the RTO?

Our Recommendation: We understand your worries about the BH series number plate and transferring the ownership of your vehicle. Let me address your queries one by one:

1. Process to Transfer BH Series to State Series Number

Transferring a vehicle with a BH (Bharat) series number plate to a state series number plate involves a few steps, but as of now, the exact process might not be fully detailed online. Here’s a general outline of the steps you would likely need to follow:

- Visit the RTO: Since the online Parivahan portal does not have the option, you'll need to visit the RTO in person.

- Obtain the No Objection Certificate (NOC): You will need to get an NOC from the Pune RTO where the vehicle is currently registered.

- Submit Documents: Prepare the necessary documents including the current registration certificate (RC), insurance papers, pollution under control (PUC) certificate, and address proof.

- Submit Form 20, 27, and 28: These forms are generally used for applying for re-registration and obtaining the NOC.

- Vehicle Inspection: The vehicle might need to be inspected at the Nashik RTO.

- Pay Fees: There will be fees involved for the re-registration process.

- Re-Registration: Once the NOC is obtained and documents are verified, the Nashik RTO will re-register the vehicle with a new state-specific number.

2. Eligibility for BH Series Number

Since you work for Infosys Ltd., which has offices in multiple states, you are indeed eligible for a BH series number. The BH series is meant for employees of private sector companies with offices in four or more states/UTs and for central/state government employees.

Documents Required

To apply for a BH series number, you would need the following documents:

- Employment Certificate: A certificate from Infosys stating that you are employed with them and that they have offices in 4+ states.

- Proof of Address: Address proof documents like Aadhaar card, utility bills, etc.

- Form 60/61: Declaration form for those who do not have a PAN card.

- Identity Proof: PAN card, passport, or any government-issued ID.

- Proof of Office Presence in Multiple States: A letter from your employer or any official document that confirms Infosys has offices in multiple states.

Current Status and Legal Matters

There has been some legal debate over whether BH series numbers should be issued to private employees, but as of the latest updates, employees of private companies with a presence in multiple states are eligible. However, regulations can vary by state, and ongoing court cases might affect the implementation.

Recommendations

- Consult with Local RTO Officials: Visit the Nashik RTO and Pune RTO to get the most current and accurate information.

- Seek Legal Advice: If there’s a legal case ongoing, you might want to get advice from a legal expert on the implications.

- Official Website: Keep an eye on the Parivahan Sewa website for any updates or changes in the policy.

We hope this helps clarify the process and your eligibility. Feel free to reach out if you have any more questions!

People Also Ask (FAQs)

Can I Convert My Existing Car Registration To BH Series?

Yes, it can be done as long as you are eligible for the BH series number plate. The application process is simple and requires you to upload the necessary documents and pay the road tax. If you want to apply for the BH series number plate, you need to comply with any of the following conditions:

- Central and state government employees

- Employees of PSUs such as BHEL, ONGC, BSNL, etc.

- Defence personnel

- Employees of a company having offices in at least 4 states/UTs

Here is a step-by-step guide on how to convert your existing car registration to the BH series:

- Check your eligibility: Make sure you meet the eligibility criteria for the BH series number plate.

- Visit the Vahan portal: The Vahan portal is the official online platform for vehicle registration in India.

- Select a dealer: You can choose to apply for the BH series number plate through a dealer or on your own. If you choose to apply through a dealer, they will assist you with the application process.

- Complete the application form: You will need to provide your personal details, vehicle details, and employment details.

Provide required documentation: You will need to upload the following documents:

- PAN card

- Aadhaar card

- Official ID card (for government employees)

- Form 60 (for private sector employees)

- Working certificate (for private sector employees)

Vehicle inspection: In some cases, your vehicle may need to undergo a physical inspection to ensure it meets the necessary criteria for BH series registration.

Can I Buy Or Sell A Used Car With BH Number?

Yes, there are no restrictions on this. The vehicle buyer must apply for registration in their regional RTO office to obtain the regional registration number. Similarly, a BH-series registered vehicle can be purchased and re-registered from the regional RTO office.

Can I Transfer BH Registration To A Person Who Is Not Eligible For BH Registration?

Yes, a vehicle can be sold to someone who isn't eligible for a BH registration. However, the new owner will need to apply for a new registration number and pay the fee and applicable taxes as per the regulations of the state/union territory.

Also Read: How To Read Car Tyre Markings? – All You Need To Know

Are BH Registered Vehicles Transferrable?

Yes, they are transferable to both BH-series eligible buyers and non-eligible buyers. In case of eligibility, the new owner will get a fresh BH-series registration number. If not eligible, the new owner will get the regular registration number as per the registration sequence of the regional RTO.

Can I Apply For BH Series Number Plate With My Old Vehicle?

Yes, If an existing vehicle owner is eligible for BH registration, then he/she can fill the form no. 27(A) and submit it in the same state's RTO.

Who Is Eligible For The BH Series Number Plate?

The following category of individuals are eligible for a BH-series number plate

- Central and state government employees

- Employees of PSUs such as BHEL, ONGC, BSNL, etc.

- Defence personnel

- Employees of a company having offices in at least 4 states/UTs

What Happens If I Sell The BH Number Plate Series Vehicle

If you sell your BH series vehicle and the new owner is eligible for BH series registration, he/she will receive a new BH series number plate as per the ongoing sequence of the regional RTO. However, if the new owner is not eligible for the BH series registration, he/she will get the regular series number plate as per the ongoing number sequence from the regional RTO.

Can I Transfer My Old BH Number To My New Vehicle?

No. All new vehicles will get a new BH series number plate as per the ongoing sequence of your regional transport office (RTO).

Can I Sell My BH Series Car?

Yes. A BH series car can be sold like any other vehicle. Also, like any sale, some specific documents or procedures need to be followed especially if the buyer is from another state.

Here are some steps you may need to take to sell your BH series car:

Transfer of Ownership: Ownership of the vehicle must be transferred to the buyer. This usually involves filling out the relevant forms and submitting them to the Regional Transport Office (RTO).

Clearing Outstanding Dues: Make sure there are no dues on the vehicle, such as unpaid loans or outstanding fines.

Sales Agreement: Draft a sales agreement with the buyer, outlining the terms and conditions of the sale.

Document Delivery: Provide all required documents to the buyer including Registration Certificate (RC), insurance documents, Pollution Under Control Certificate (PUC) and any other relevant documents.

Payment: Receive payment for the sale of the buyer's vehicle.

Inform the RTO: Inform the RTO about the sale of the vehicle by submitting the required forms and documents.

Registration Transfer: If the buyer is from out of state, the vehicle registration may need to be transferred to your state. However, since BH series vehicles are already registered for interstate movement, this step may not be necessary.

Always consult the local RTO or a legal expert to ensure that all necessary procedures are being followed while selling your BH registration car. Additionally, check for any specific rules or regulations in your state or the buyer's state regarding the sale of BH series vehicles

Also Read: Tips to Increase Car Mileage - CNG, Petrol & Diesel

If we want to sold a BH series car how will we get NOC and other formalities

Can the BH registered vehicle be transferred to dependents.

If I am working in private sector, will I required form 60 in every 2 years or only first time??

A vehicle with BH registration can be transferred or sold to someone who is not eligible for the vehicle.

What should be the base for calculation of Road Tax under BH Series? A. Ex-showroom price B. Ex-showroom price excluding GST of 28% + 1%Cess

In case if we want to sell the car, what is the process.

Hello . Can you confirm if seafarers can get BH number series car ?

What If I want to sell my car with BH Numberplate?

In case, RTO is not accepted the BH series/registration in state government. What to do...

Hi I want to transfer my kerela register car in to BH series, I am working IT company in Bangalore, Is this possible to re register in BH series?

I have an MH12 number car which I purchased in April 2022. I am eligible for BH series, my only concern is what will happen to the tax I already paid for 15 yrs. If I get clarity on that, then I can make my decision on proceeding with BH series registration of my current car.

Karnataka is not providing bh series for private employees , can we go and buy a car in other state with bh registration?

Hi, Thank you for the article.. Which answers most of my questions.. Just need one more clarification.. Let assume at the time of purchase, I was eligible candidate for BH series, but after 2 years I moved to a different company which does not qualify for BH registration... Will it create any problem in car's RC renewal..??

I think high time we have BH for everyone . No more state business . One India One Tax

I need your help in BH registration

I am going to sell a car with bh series but the rto office for that vehicle is Chandigarh but the buyer belongs to tamilnadu and non-eligible person..how can i sell?

Get update for BH passing

Now old vehicles also can opt for BH series number. So the 1st point in the CONS needs to be corrected.

Hi, I am planning to buy car which would be on company name while I will be using that vehicle as a perk from the company to me, can I get BH number registration.

What will happen if a person retires or leaves the company?

Can I take a vehicle with BH registration through Private company's Corporate Lease Program? If yes, is it mandatory to register the vehicle in the same state based on the current work location or is it fine to register based on permanent address. Currently, BH registration is not allowed in Karnataka for private employees; hence exploring options. Appreciate a response.

Presently I am eligible for BH series being a Public sector employee. I am going to retire after 5 years then what will happen to my BH series, whether it will continue? or I have to change and go for regular registration of the state.

I am working at mnc and I am eligible for bh series number plate. If I got BH series number and after two years I left the mnc job and got another job in non mnc firm then what should I do then will bh series number will be continued with me or invalid .....please answer my questions?

I am applying for BH registration and i am working in IT company in Bangalore and my company has office has in 6 states but still Karnata RTO is not approving it .. i have payed amount in Bangalore is it possible i can apply in other states where i can get BH registration?

Is toll tax exempted for BH number vehicles

I am Polic constable in maharshtra state police ( State Government Employee.)since 12 years.. And i dont get transfer in other state....am I eligible for this BH series...??

If i brought BH series & fill tax for 2 yrs after 2 yrs the amount of tax same or less according to the value of vehicle .

I have Purchased a new car from Hyundai, Also eligible with above criteria (i.e. Employees of a company having offices in at least 4 states/UTs) but KARNATAKA CHIKODI (KA23) RTO Office denied to provide an BH Series saying there is a currently case going on in court for an issuing BH for Private sectors. How true is it and in-order to get BH series what can be done from my end.

Is it necessary to have office in the state for a PSU For BH series no.For ex a person working at Mumbai in a PSU and what BH series no vehicle in Patna Bihar is it allowed??

I'm a govt bank employee... I have applied for bharat series number but my application got rejected stating that you must serve in 4 states as of now. Then only you are eligible for this number The documents i have enclosed in the application are My photo Adhar card I'd card (psb bank I'd card) Rent agreement Joining letter Working certificate Copy of Business certificate of bank doing buisness in 4 states. But still Rto rejected my application stating that you must have served in 4 States as of now.

A govt. Employee has 3 years of service left before retirement and gets a BH registration for new vehicle , then what happens to the BH registration after 3 years , i.e when the employee retires ? Does he have to pay the rest of the tax lumpsum based on BH series tax rate or on Karnataka RTO's tax rate ? Or BH series tax schedule continues ?

Reply: okay

What happens if i change job and its not located at four or more locations ?